Financial leverage is more expensive for a company in the sense that products such as loans and high-yield bonds pay higher interest rates to compensate investors for taking more risks. It is certain that borrowings are usually payable with interest which is quite high. The higher hiring employees the interest rate, the lower a company will want to take on debt to finance its assets. A company’s financial leverage decision is a part of its financing strategy planned by the directors. Individuals may also make use of leverage to make large and one-off purchases.

A company with a high debt-to-equity ratio is generally considered a riskier investment than a company with a low debt-to-equity ratio. Using leverage can result in much higher downside risk, sometimes resulting in losses greater than your initial capital investment. On top of that, brokers and contract traders often charge fees, premiums, and margin rates.

It involves using both debt financing and fixed costs to purchase assets or invest in projects. The degree of financial leverage (DFL) measures the percentage change in EPS for a unit change in operating income, also known as earnings before interest and taxes (EBIT). Financial leverage refers to the use of borrowed capital to increase the potential return on investments.

Share This Article

A D/E ratio greater than one means a company has more debt than equity. Each company and industry typically operates in a specific way that may warrant a higher or lower ratio. Financial leverage can help you tap into bigger investments, but it comes with increased risk. Still, the chance at accelerated growth and increased returns might be worth it to you.

- Leveraged ETFs are self-contained, meaning the borrowing and interest charges occur within the fund, so you don’t have to worry about margin calls or losing more than your principal investment.

- The equity multiplier attempts to understand a company’s ownership weight by analyzing how assets are financed.

- The annual profit generated by the factory is$150,000 on a $100,000 cash investment.

- A high ratio means the firm is highly levered (using a large amount of debt to finance its assets).

- In the previous article, I offered a comprehensive overview of RILY’s operating segments, honing in on revenue drivers and trends.

There is usually a natural limitation on the amount of financial leverage, since lenders are less likely to forward additional funds to a borrower that has already borrowed a large amount of debt. Using as much intelligence as possible to inform data-driven solutions is crucial. Numerous

financial firms and banks have received huge fines for failing to perform rigorous customer assessments. In 2022, KYC and AML non-compliance penalties soared, resulting in a total of

£215,834,156 in fines. Therefore, it’s imperative that financial institutions do everything they can to address these issues – for their own sake as well as to help mitigate the risk of financial

crime. RILY’s notes are traded on public exchanges, and their high yield has attracted interest among retail income investors.

For example, a person investing in real estate might be able to buy multiple properties and increase their returns by using several loans, rather than all cash. The financial leverage of any business entity is measured by the ratio of debt to total assets. When the ratio of debt as compared to assets increases, the financial leverage of the business entity also increases.

Amplifies shareholder profits

Financial leverage can be used strategically to position a portfolio to capitalize on winners and suffer even more when investments turn sour. If the investor only puts 20% down, they borrow the remaining 80% of the cost to acquire the property from a lender. Then, the investor attempts to rent the property out, using rental income to pay the principal and debt due each month. If the investor can cover its obligation by the income it receives, it has successfully utilized leverage to gain personal resources (i.e. ownership of the house) and potential residual income.

Fitch Affirms MDC Holdings, Inc.’s IDR at ‘BBB-‘; Outlook Stable – Fitch Ratings

Fitch Affirms MDC Holdings, Inc.’s IDR at ‘BBB-‘; Outlook Stable.

Posted: Wed, 02 Aug 2023 18:26:00 GMT [source]

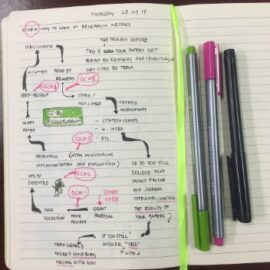

This piece attempts to rectify this drawback, offering a comprehensive overview of RILY’s asset accounts, from the largest to the smallest. If EBIT had decreased instead to $70 million in Year 2, what would have been the impact on EPS? EPS would have declined by 33.3% (i.e., DFL of 1.11 x -30% change in EBIT). This can be easily verified since EPS, in this case, would have been 60 cents, which represents a 33.3% decline. In this instance, EPS has increased from 90 cents in Year 1 to $1.10 in Year 2, which represents a change of 22.2%. Gordon Scott has been an active investor and technical analyst or 20+ years.

What Is an Example of Financial Leverage?

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. “We are committed to providing the best possible higher education and career services to Indian students going abroad to study. We launched Fly Homes with a singular aim of providing end-to-end solutions to students.

Capital structure can be defined as the distribution of the equity(owner-financed) and debt (borrowed money) in the firm’s capital. Baker Company uses $100,000 of its own cash and a loan of $900,000 to buy a similar factory, which also generates a $150,000 annual profit. Baker is using financial leverage to generate a profit of $150,000 on a cash investment of $100,000, which is a 150% return on its investment. On the surface, it appears as if RILY is preparing to fund next year’s dividends through the equity raise, a move that contradicts management’s stated intention of supporting dividends through operations.

Financial leverage ratios

Though this isn’t inherently bad, it means the company might have greater risk due to inflexible debt obligations. The company may also experience greater costs to borrow should it seek another loan again in the future. However, more profit is retained by the owners as their stake in the company is not diluted among a large number of shareholders. Margin is a special type of leverage that involves using existing cash or securities position as collateral used to increase one’s buying power in financial markets. Margin allows you to borrow money from a broker for a fixed interest rate to purchase securities, options, or futures contracts in anticipation of receiving substantially high returns.

Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Financial leverage is also known as leverage, trading on equity, investment leverage, and operating leverage. Traditionally, KYC verification has been a slow, manual, and inefficient process which has left room for significant errors, data gaps and quality problems.

How we use your personal data

However, when the debt-to-equity ratio is below 1.0 it indicates that a business has a low debt compared to its equity. On the other hand, a ratio of 1.0 implies that the company’s equity and debt are the same. A ratio of about 0.5 is a good one and shows that the company’s assets are twice as much as its liabilities. But again, the financial leverage ratio varies and will depend on the specific ratio referred to. If the financial leverage is positive, the finance manager can try to increase the debt to enhance benefits to shareholders.

In November 2020, it converted its loans to Lingo into a 40% stake before acquiring an additional 40%. Another example is RILY’s $60 million debt to Harrow Health, which was brought to light by Wolfpack Research earlier this year. It is worth noting that since Wolfpack’s article, Harrow Health has repaid RILY’s debt in full, in addition to interest. Harrow funded RILY’s debt repayment by borrowing from Oaktree Capital Management, the external manager of Oaktree Specialty Lending (OCSL), and Oaktree Strategic Income (OCSI).

It involves using debt financing, such as loans or bonds, to buy assets or invest in projects, which expect to generate higher returns than the cost of borrowing. Financial leverage results from using borrowed capital as a funding source when investing to expand the firm’s asset base and generate returns on risk capital. Leverage is an investment strategy of using borrowed money—specifically, the use of various financial instruments or borrowed capital—to increase the potential return of an investment. Leverage can also refer to the amount of debt a firm uses to finance assets. The degree of financial leverage is a ratio that measures how sensitive a company’s earnings per share are to its operating income as a result of the changes that occur in its capital structure.

Degree Of Financial Leverage

Professional investors and traders take on higher levels of leverage to more efficiently use the money they have to invest. In general, you can borrow up to 50% of the purchase price of margin investments. Consumer Leverage is derived by dividing a household’s debt by its disposable income. Households with a higher calculated consumer leverage have high degrees of debt relative to what they make and are therefore highly leveraged. The formulas above are used by companies that are using leverage for their operations.

High leverage may be beneficial in boom periods because cash flow might be sufficient. Therefore, it is suggested to have a trade-off between debt and equity so that the shareholders’ interest is not affected adversely. Total debt, in this case, refers to the company’s current liabilities (debts that the company intends to pay within one year or less) and long-term liabilities (debts with a maturity of more than one year). Keep in mind that when you calculate the ratio, you’re using all debt, including short- and long-term debt vehicles.

This is because there may not be enough sales revenue to cover the interest payments. During times of recession, however, it may cause serious cash flow problems. Both of them, when taken together, multiply and magnify the effect of change in sales level on the EPS. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. That means if an index rose 1% in a particular day, you might gain 2% or 3%.

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Leave A Comment